People often ask me what it means to work in insurance or ‘portfolio optimisation’ and I rarely have a good response. Well, this blog post is my ‘answer’ to that question in the form of a loose, friendly analogy - it’s more interesting and fun this way.

Today folks, we’re talking about bakeries.

An analogy

Imagine for a second that you own a bakery,

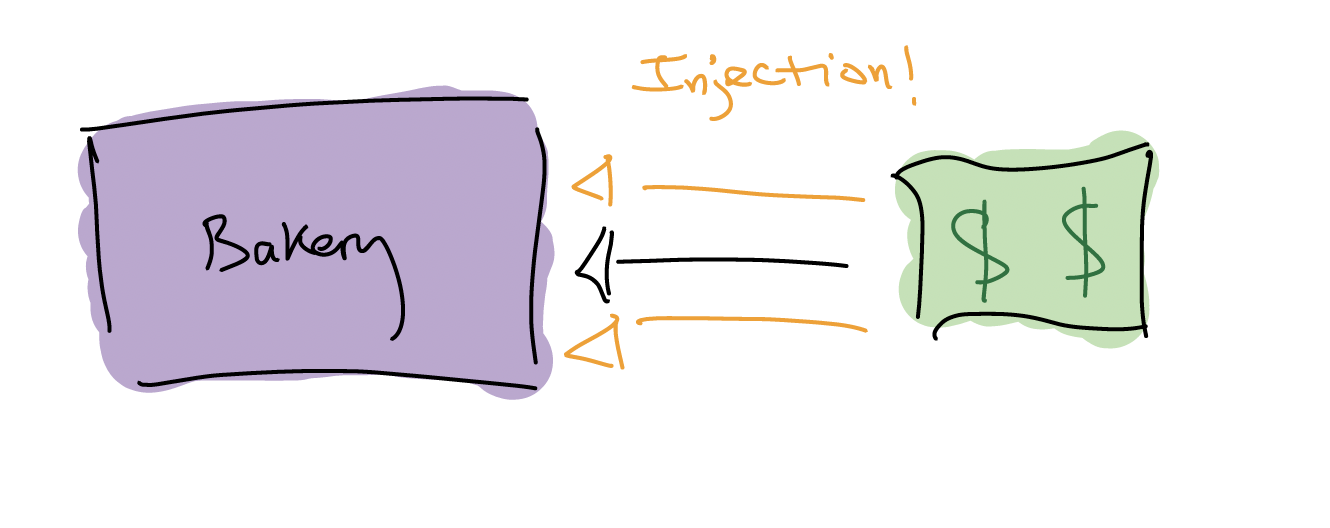

Now a bakery - just like any business really - needs money to operate.

You can’t just ‘magic up’ a company with no money: how are you going to pay for everything?

To that end, you recruit an investor. Perhaps it’s a sweet family member, your partner or a third-party shareholder that you have no relationship to. Whatever the case: you now have some cash!

So you have your first cash injection. Woohoo!

You set aside a small portion of this for yourself in the form of an initial ‘salary’ but you decide to deploy the remainder of this seed investment in the form of capital expenditure: you purchase an oven (and other appliances), kitchen utensils and a rota of fresh ingredients.

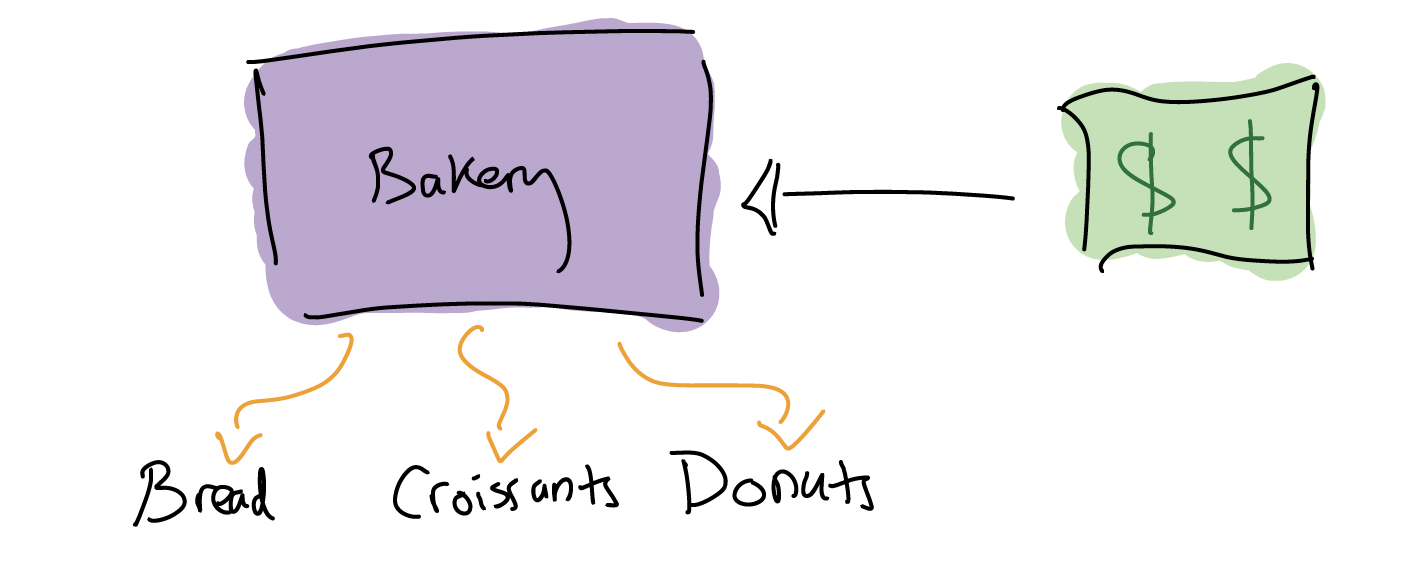

The latter of these will become a recurring expense but you will hope to pay for this, in the future, via the sale of your products. It’s worth mentioning that in most scenarios this is fine: the profit earned from sales will more than pay for the cost of producing your goods.

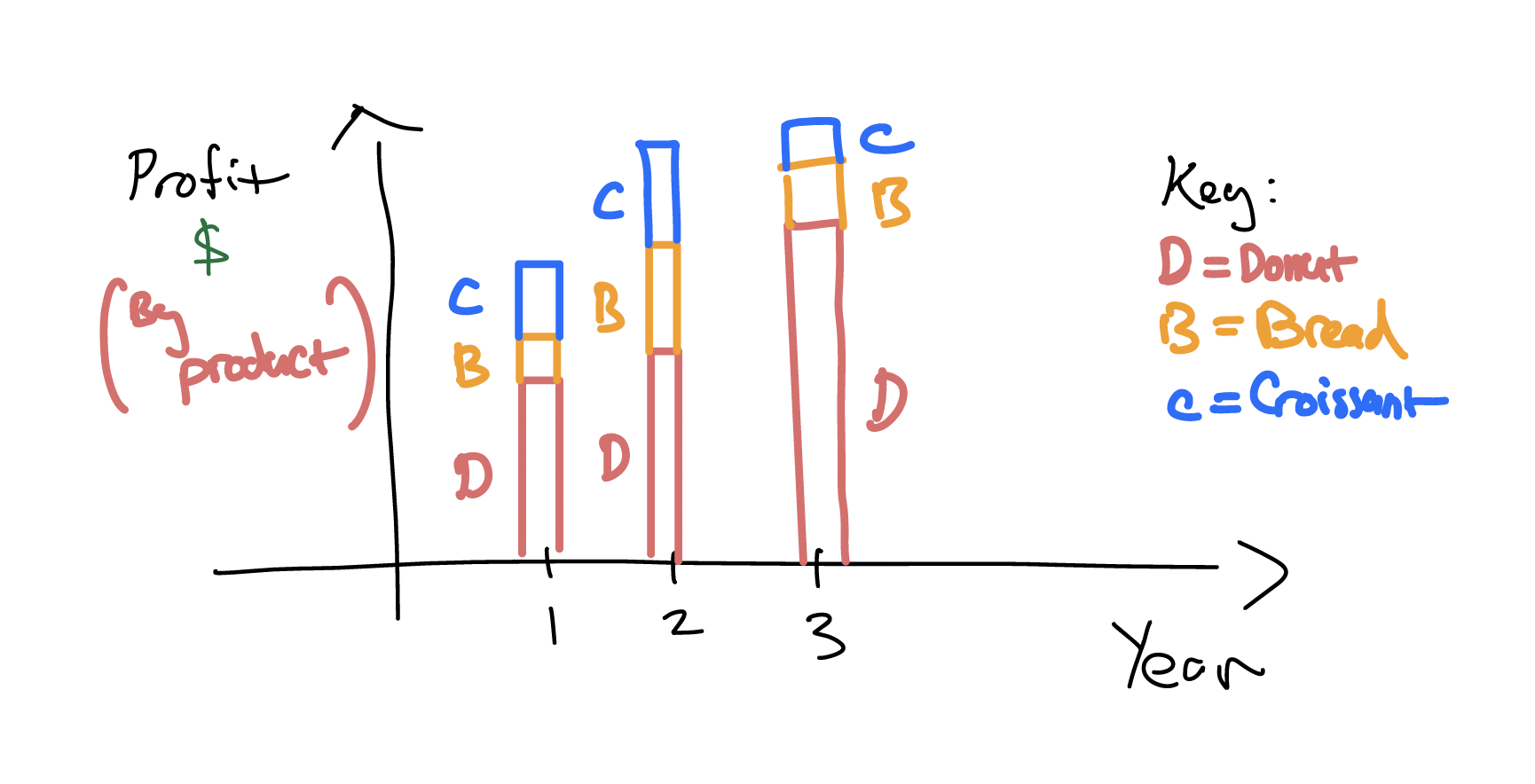

You’re ready to bake! You get cracking and decide to start selling three products: croissants, bread and donuts,

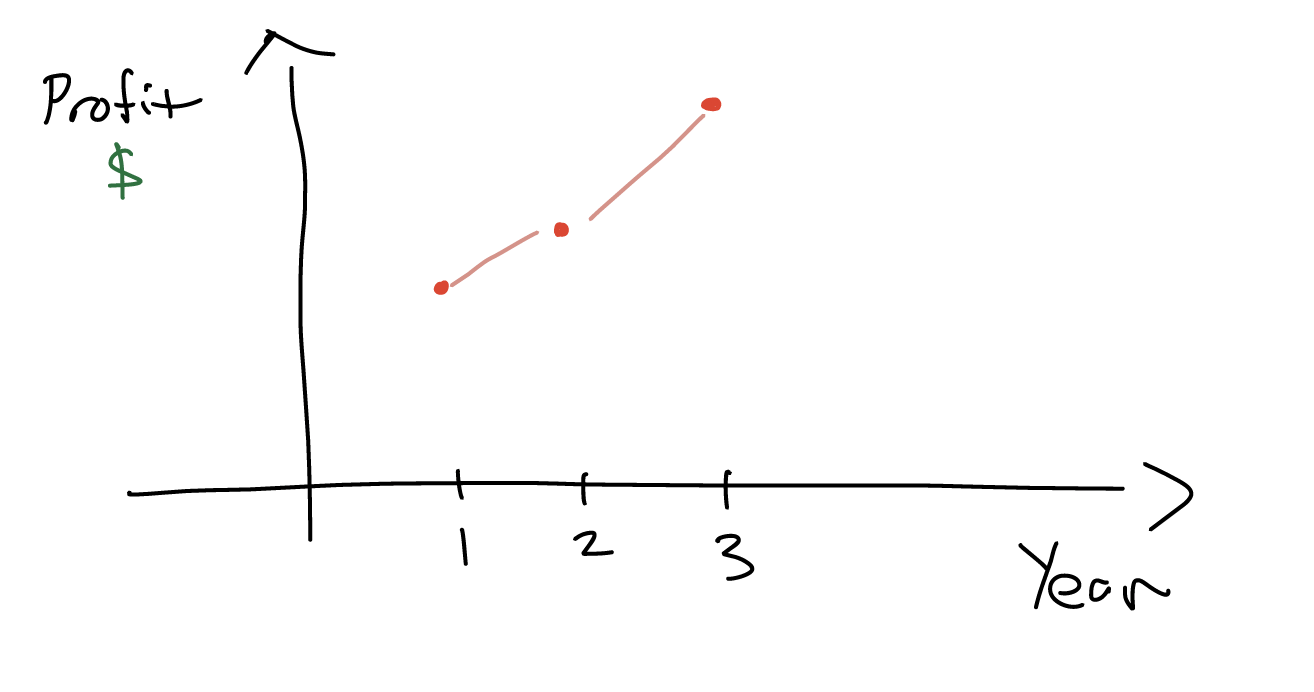

Since you’re a really popular person and you bake such lovely treats, business booms in the first few years of operation,

You’re simply amazed and couldn’t be happier! You check the underlying numbers and notice that donuts are a real contributor to your bottomline,

So you decide to ramp up on donut production - they’re selling great and everyone loves them.

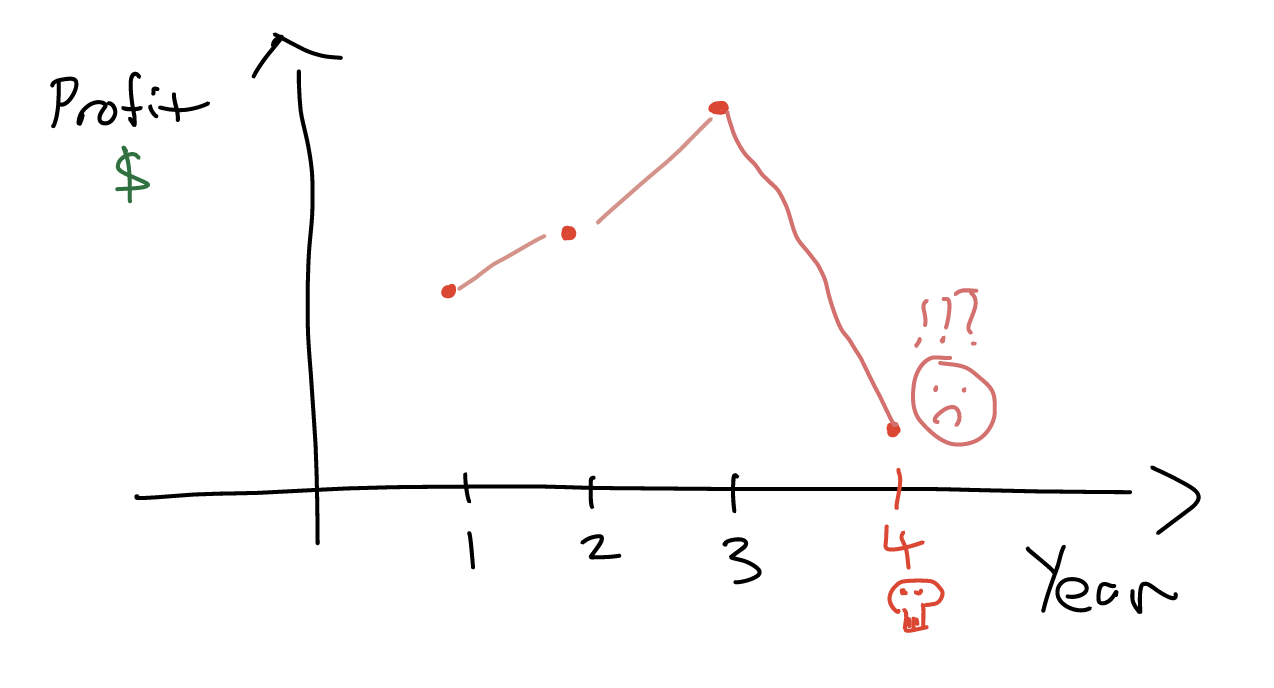

But then… something bad happens: in year 4 your business takes an absolute nosedive,

What the heck happened?

You frantically sift through your accounts only to uncover the completely shocking (but predictable) culprit:

That’s right: your most profitable item is now the primary cause of an epic downturn. You simply couldn’t see this coming!

As it turns out (and you’ll have to suspend your disbelief and forgive me for the foolish analogy just this once!): the price of ‘sprinkles’ has risen astronomically during the course of year 4 causing costs to skyrocket.

And now you have a real problem that requires some thought to solve: should you continue producing the same number of donuts? Should you decrease the production of donuts?

You’ve got a few options.

You might, for example, continue ‘as is’ and ask your investors for more money ‘just in case’ things blow up again,

But now your investors are expecting more from you: they could’ve invested that money elsewhere - perhaps in a more secure investment vehicle - so the pressure’s on for you to deliver.

At the same time, you’re now being extra cautious about the ‘composition’ of products that you sell; at this point, you might decide to get rid of the ‘sprinkles’ on your donuts. After all, the price of sprinkles is what caused this fiasco in the first place - perhaps that will stabilise profits in the long run?

Without conducting experiments, though, you can’t be sure. There are a lot of questions and no easy answers here. But perhaps the ultimate question is: what is the ‘optimal’ allocation of products and resources (financial or otherwise) for our bakery?

Bringing it back home

If you read between the lines - and replace the baked goods with ‘contracts’ - running that little bakery is a bit like running an insurance company. To truly manage a portfolio of contracts in a ‘sensible’ way is to ask ourselves the question: how can we operate in a profitable but sustainable manner? How can we operate in a way that respects our customers and our shareholders alike?

The answers to these questions are highly non-trivial but they essentially involve a mixture of statistical modelling and expert judgment. As an engineer and/or data scientist, I get involved in the foremost of these activities: building algorithmic software to help the business understand how to manage their portfolio in the future.

It’s a fun place to be and I hope this blog post actually served as a suitable ‘explainer’ for how and what I do.